|

| The Gorilla Daily Email |

Subscriber Log In |

| Monday 4/28/2025 |

|

| Stocks Edge Higher Ahead Of Key Tech Earnings |

|

|

| GorillaTrades Menu of Ideas |

|

New Potential

Gorilla Picks |

Recently

Triggered |

Recently

Confirmed |

| None |

VRTX 4/28

ZS 4/25 |

VRTX 4/28

ZS 4/25

|

|

Light Volume

Pullbacks |

Special

Situation Picks |

Gorilla

Picklets |

| None |

None |

None |

|

|

|

| Gorilla Watchlist |

|

| Company |

Symbol |

Current Price |

| None |

|

|

|

Trigger

Price |

Confirmation Volume |

Deadline |

| |

|

|

|

|

|

| Recently Triggered GorillaPicks |

|

| Company |

Symbol |

Date

Triggered

|

Vertex Pharm.

Zscaler

|

VRTX

ZS

|

4/28

4/25

|

|

| Trigger

Price

|

Current

Price

|

Stop

Loss

|

Target Prices

T1 T2

|

$494.93

$212.36 |

$496.49

$219.86

|

$452

$191

|

|

|

|

|

| Recently Confirmed GorillaPicks |

|

| Company |

Symbol |

Trigger

Price |

Confirmed

Price |

Vertex Pharm.

Zscaler

|

VRTX

ZS

|

$494.93

$212.36

|

$496.49

$215.58 |

|

Confirmed

Date |

Current

Price | Stop

Loss |

Target Prices

T1 T2 |

4/28

4/25 |

$496.49

$219.86 |

$452

$191 |

|

|

|

|

| Transactions Closed Today |

|

| None |

|

| Portfolio Update |

|

The GorillaTrades portfolio was much stronger today, as 13 of the 14 GorillaPicks finished higher. Only portfolio laggard Post Holdings (POST) dipped 1.4%. Conversely, Zscaler (ZS) led among the winners, gaining another 2%.

Thus, 13 of the 14 confirmed GorillaPicks in the GorillaTrades portfolio hold unrealized gains, including six with double-digit gains. Only Post Holdings (POST) holds just a 2.5% unrealized loss. Kroger (KR) and Atmos Energy (ATO) hold 22% and 33% unrealized gains, respectively, while Brown & Brown (BRO) leads the portfolio with a huge 71% gain. In addition, seven different GorillaPicks have achieved their first targets.

*Please click HERE to view all of the HIGHLIGHTED stop loss and target adjustments for this week: Current GorillaTrades Portfolio (http://www.gorillatrades.com/subscribers/long) |

|

|

|

| Gorilla Commentary |

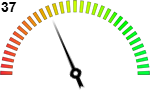

Price Action:

|

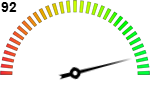

Overbought/Oversold:

|

Bearish 0-100 Bullish

Price action improved across the board in the second half of the day, but stocks continue to face short-term technical headwinds in most “risk-on” sectors. |

Overbought 0-100 Oversold

The large-cap benchmarks and the Russell 2000 are still oversold, from a momentum perspective, but the indices are quickly approaching neutral territory. |

|

|

| Index |

G/L |

Current level |

Year-to- date |

50-day MA |

200-day MA |

| Dow |

+114 |

40,228 |

-5.4% |

41,581 |

42,110 |

| Nasdaq |

-17 |

17,366 |

-10.1% |

17,682 |

18,333 |

| S&P 500 |

+4 |

5,529 |

-6.0% |

5,624 |

5,746 |

| Russell 2000 |

+8 |

1,965 |

-11.9% |

2,028 |

2,191 |

|

|

|

Advancing issues outnumbered decliners by a 5-to-4 ratio on the NYSE today (compared to the GT portfolio's massive 13-to-1 winning ratio), with 20 stocks hitting new 52-week highs and only seven stocks hitting fresh 52-week lows, while volume remained moderate.

·The major indices finished mixed, despite a tech-led morning selloff, with trade and growth fears still weighing on investor sentiment ahead of a massive week of economic releases and corporate earnings

·The tech sector and the Nasdaq still finished the day in the red as Nvidia (NVDA, -2%) and Google parent Alphabet (GOOG, -0.9%) fell, but the Dow showed relative strength, with the industrial average spearheading a late-day rally in stocks

·Treasury Secretary Scott Bessent stated that it is up to China to de-escalate following this month's “tit-for-tat” tariff skirmish with the U.S., and, according to President Trump, talks between the two countries are already underway

·Small-caps continued to outperform the rest of the market following last week’s rally, with the Russell 2000 scoring an over-three-week high

·Treasury yields and the dollar dropped as hopes of a quick trade deal with China faded, with the benchmark 10-year yield closing well below the 4.25% level

The main sectors diverged substantially throughout the session, but even the worst-performing sectors held on to most of their recent gains. Tech, communication services, and consumer stocks lost the most ground, with industrials also closing the day in the red, while materials, financials, and healthcare trod water. The rate-sensitive utilities and real estate sectors showed the most promise thanks to today's dip in rates, with energy stocks pushing higher as well despite crude oil's steep drop.

Traders said the market conditions continued to normalize today, despite the major indices' mixed performance. As one trader explained, “Even though the Volatility Index (VIX, +1.3%) edged higher today, the market continued to heal, with the key breadth measures all improving and stocks finishing near their intraday highs across the board.” |

| Read Full Commentary |

|

| New Potential GorillaPick |

|

| Symbol: |

|

| Name: |

None |

| Industry: |

|

| Trigger Price: |

|

| Confirmation Volume Area: |

|

| First Target: |

|

| Second Target: |

|

| Stop Loss: |

|

| Risk Rating: |

|

| Dividend Yield: |

|

|

| Quote of the Day: |

"Take care not to listen to anyone who tells you what you can and can’t be in life."

-Meg Medina |

| Key Long-Term Technical Levels: |

| Index |

Support |

Resistance |

| Dow |

28,700 +/- |

45,100 +/- |

| Nasdaq |

10,000 +/- |

20,300 +/- |

| S&P |

3,500 +/- |

6,150 +/- |

|

|

|

| Question & Answer |

|

Q. Dear Gorilla, if a stock no longer shows up under Recent Special Situation Picks, does that mean the stock should no longer be considered for purchase or sold? I have noticed that the most recent SSP, Hallador Energy Company (HNRG, )has jumped out of the gate with quick gains. Thanks for your help.

Read the Answer |

|

| Questions? Get More Info Here |

|

|

|

|

|

|

| |

A Note From The Gorilla...

Attention Current, Paid Subscribers: The Gorilla receives so many questions, that if he answered, would be considered as giving "personal investment advice." The Gorilla wishes he was legally able to answer these types of questions. However, one of the reasons that he developed the GorillaTrades Forum was to give his subscribers the ability to get answers to these kinds of questions. The Gorilla has always contended that his subscribers are among the most intelligent investors in the world, so why not let your fellow subscribers answer your personal questions? Don't be shy. Give it a shot! Post your questions and/or answers in the GorillaTrades Forum now. After all, the future of this feature hinges upon YOUR participation, so head to the "Subscriber's Home Menu," click on "GorillaTrades Forum," and post your first idea or question now. And to those of you on a free 30-day trial, we look forward to you becoming a paid subscriber and having the ability to participate in our forum as well!

|

The GorillaTrades "portfolio" is a collection of investment ideas, which are meant to be filtered according to your investment style and tolerance for risk. All investing involves risk. Always invest according to your own tolerance for risk and use a stop loss.

Copyright GorillaTrades 1999-2025. All Rights Reserved. This newsletter's viewing/use is limited to active subscriber's under the current terms of service.

|

|

|

|